Navigating the Haitian Insurance Market: A Comprehensive Guide to Coverage, Policies, and Premiums

Imagine living in a place where the vibrant culture dances on the streets and the rich history echoes in every corner. Now, imagine navigating through the complex world of insurance in Haiti—a task that might feel as daunting as scaling the Pic la Selle. With an ever-evolving Haitian insurance market, which types of coverage should you prioritize, and how do you sift through the intricacies of policies and premiums? This blog will unlock some of the secrets to help you make informed choices, ensuring that your life, health, and dreams remain protected. Let's dive into the essentials of Haitian insurance coverage, where each policy tells its own story of protection and peace of mind.

Insurance is not just a commodity; it’s a safety net that cushions us in times of peril. In Haiti, the landscape of insurance is vast and diverse, presenting options such as health insurance, auto insurance, home insurance, and life insurance. But with so many choices, how do you determine which coverage is ideal for you? Start by recognizing your risks. Are you concerned about health emergencies? Or do you want to secure your new car against accidents? Understanding your unique needs is the first step in navigating this intricate terrain.

As you explore the Haitian insurance market, you might encounter various insurance providers and brokers, each offering different policies and premiums. But how do you choose? An insurance broker can be your guiding light—acting as a bridge between you and the plethora of available options. They have the expertise to interpret the complexities of policies, help calculate premiums, and provide insightful insurance quotes that reflect your specific needs. With their support, you’ll be empowered to makes choices that not only align with your budget but also deliver the coverage necessary for your peace of mind.

What about claims? Understanding the insurance claim process is crucial to your experience with any policy. Have you ever felt overwhelmed when trying to file a claim? With the right information from your insurance agency, the process doesn't have to be a nightmare. Many agencies in Haiti now offer online insurance options that include digital resources and informational web portals, making claims easier to navigate. In a world where digital is becoming the norm, these web services allow for streamlined processes, freeing you from the headache of paperwork and providing quick solutions when you need it most.

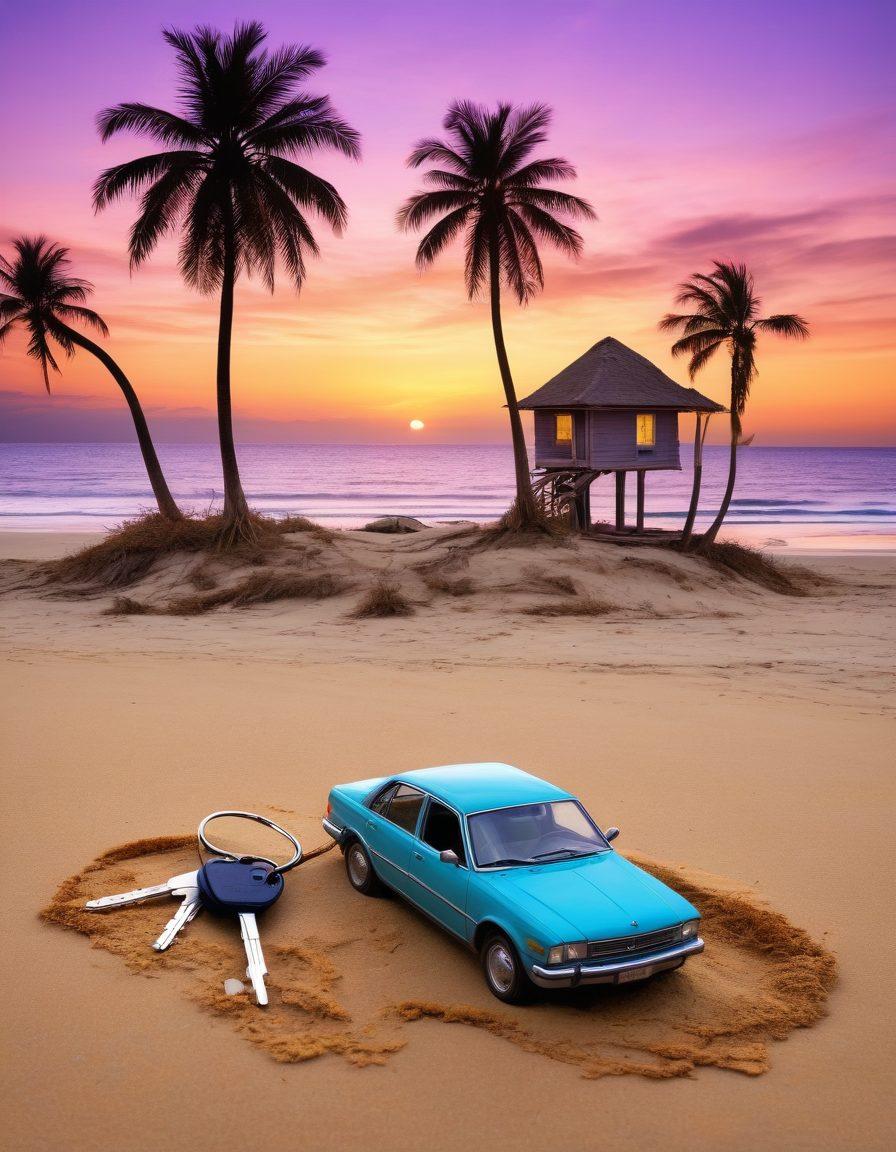

Ultimately, the journey through the Haitian insurance landscape is about securing your future. Whether you’re seeking coverage for your health, your home, or your vehicle, the keys to understanding and accessing the right insurance lie in research and communication. By leveraging available web resources and consulting with seasoned insurance professionals, you can demystify the complexities of the Haitian insurance market. Remember, it’s your future at stake—so why not equip yourself with all the knowledge you can gather? Let’s unlock the doors to informed insurance decisions together!

Mastering Policies and Premiums: Your Ultimate Guide to Haiti's Insurance Landscape

Navigating the labyrinth of Haiti's insurance landscape may seem daunting at first, but fear not! Mastering policies and premiums in this vibrant republic is not only achievable; it's liberating. Imagine having the peace of mind that comes with knowing you're safeguarded against life’s unexpected twists and turns. Whether it’s health insurance that keeps your family healthy, auto insurance that protects your wheels, or home insurance for your cherished abode, understanding the nuances of coverage and premium can transform your relationship with risk management entirely. So, how can you become an informed player in the Haitian insurance market?

Let’s start with the fundamentals: a policy is your agreement with an insurance provider. It outlines what is covered, the limits of that coverage, and how claims will be settled. This essential document can feel overwhelming, but remember, every Haitian insurance policy is a tool designed to protect you. Imagine if life threw a curveball your way—like an unexpected health crisis or a car accident; having the right policy means you’re not left high and dry. Did you know that selecting an insurance agency with a strong reputation can be the difference between a smooth claims process and a frustrating battle?

Now, let’s dig deeper into premiums. Premiums are the price you pay for your policy, typically on a monthly or annual basis. Think of them as your ticket to peace of mind, yet they often come with tough choices. How do you know you’re getting the best insurance quote for your needs? The answer lies in comparison. As you consider your options, aim to reach out to an array of insurance brokers who can provide you with personalized guidance through this intricate web of offerings. Ask questions: What are the differences between health insurance plans? Is auto insurance really necessary if you only drive occasionally?

Utilizing the power of online insurance resources can also be a game-changer. Today’s digital world allows you to access web portals that compile vital information about various policies and premiums in Haiti. This online information helps demystify what coverage options are available and allows for a deeper understanding of the Haitian insurance market without needing to step out of your home. With just a few clicks, you can compare quotations from different insurance providers, making it easier for you to make informed decisions about how to safeguard your assets.

Lastly, never underestimate the power of asking for advice from locals or seeking out community forums. Sharing experiences or seeking insights from fellow Haitians can provide you with information that isn’t found on any informational web. There’s something profound about community wisdom which can reduce the gap between uncertainty and confidence when it comes to navigating the complexities of insurance policies and premiums. So, are you ready to take the reins on your Haiti insurance journey? It's time to master policies and premiums—because the best way to predict your future is to prepare for it!

Finding Peace of Mind: Navigating Health, Auto, Home, and Life Insurance in Haiti

Finding peace of mind can often seem like an elusive goal, especially when it comes to managing risks associated with health, home, auto, and life in a vibrant and dynamic country like Haiti. With a unique Haitian insurance market to navigate, understanding the various insurance options available can be overwhelming, yet critically important. In a land where the unexpected can often become the norm, having the right coverage is not just a luxury—it's a necessity. But where do you start if you want to secure peace of mind through the right policies and premiums? Let's explore this together.

As you delve into the world of Haitian insurance, you'll discover that health insurance is one of the most pressing concerns for individuals and families. Without proper health coverage, medical emergencies can lead to financial devastation. Think about it: If an unexpected illness strikes, would you be prepared to shoulder the costs? Health insurance in Haiti is not just about gaining access to medical facilities; it's a vital form of risk management that allows you to focus on recovery rather than worrying about financial burdens. Insurance providers often have different policies that include various levels of coverage—so be sure to get several insurance quotes before making your decision. After all, health shouldn't come with a hefty price tag.

Next, let’s hit the road—quite literally! Auto insurance serves as a crucial safety net to keep you protected while driving through the bustling streets of Haiti. Did you know that driving without insurance not only puts your finances at risk but could also lead to legal trouble? Navigating the intricacies of auto insurance is made easier with the help of an experienced insurance broker who can guide you through the extensive options. Whether you need full coverage or liability insurance, understanding the premiums associated with different policies can save you from future headaches. Remember, having auto insurance isn’t just a requirement—it’s peace of mind that accompanies every highway mile traveled.

Let’s turn our focus to what lies behind your front door—your home. Home insurance acts as the fortress protecting your sanctuary from both unexpected disasters and everyday mishaps. Whether you're renting or owning your property, ensuring you have the right coverage can safeguard you from the risks associated with theft, fire, or natural disasters. As you compare various policies in the Haitian insurance market, ask yourself this: How would you rebuild if everything was suddenly taken from you? Having the right home insurance means you won’t have to answer that question alone. With a wealth of digital resources available through informational web portals, you'll have access to invaluable insights about home insurance options and premiums.

And finally, let’s not forget life insurance—the kind of coverage that provides security for your loved ones when you aren't around. Life insurance may often feel uncomfortable to discuss, yet it’s one of the most loving decisions you can make for your family. How would your family cope financially if something happened to you? By navigating life insurance options, you’re investing in their future. Different types of policies provide varied coverage, so be sure to explore what works best for your situation. Whether you consult an insurance agency or use online insurance resources, remember that this coverage is about more than just a policy. It's a key to peace of mind—not just for you, but for those you leave behind.